You can never be too careful about your credit cards. As times become progressively desperate, unscrupulous characters are coming up with all kinds of modus operandi to steal people’s identities and their accompanying credit lines. To help prevent further incidents, here are some experiences that provide valuable lessons.

First up is loyal HSBC card holder Frances Amper Sales. She narrates her horror story. “I was at work. At merienda time, I went to eat at the office pantry with my staff and left my bag on my desk. Thirty minutes later, my husband told me that HSBC was on the phone telling him there was suspicious activity on my credit card (the one being used was a supplementary card).

“I saw that my bag was still on my desk, so I had not become worried. But upon further investigation, I discovered that my wallet was gone. I immediately canceled all my credit cards and ATM cards. But it was too late. More than P80,000 had already been charged to my HSBC account, P30,000 cash advance and P50,000++ on gadgets from SM Cubao.

Frances immediately reported the theft to their office security. As there was a security guard who screens everyone entering the office, she initially thought that it was a co-worker who had stolen the wallet. The security cameras, however, revealed a stranger – a woman – walking about nonchalantly around the office. The woman was even caught on the CCTV in the act of stealing Frances’ wallet.

Posthaste, Francis went to the police station to report the theft. She also spoke with the SM Cubao store manager. “After all, the cashier should have asked for identification considering the thief was charging thousands upon thousands of pesos to my card,” Frances says.

When she reported the incident to HSBC, she was in for a pleasant surprise. According to Frances, they responded to her “in a very bored manner.” She also found it appalling that the bank’s automated answering system assigned “To Report a Lost or Stolen Card” to a number like 3 or 4. Not surprisingly, she was peeved. “By then, after all the welcoming remarks and press-this and press-that, I was in deep distress and panic. Banks should assign a special emergency number just for lost and stolen card so that client doesn’t go through all that b—-sh-t.”

After reporting the loss, Frances had to wait for her credit card bill and then file a dispute with the bank. The dispute had to be supported by many other documents, like a police report, an affidavit, etc. The process, to say the least, was tedious and gave her a very hard time. “And no one even answers the phone when I followed up!” Frances sighs with increasing frustration. “In the end, I shouldn’t even have wasted my time – after all I did, the bank still charged the entire amount to me and said they will prosecute if if I didn’t pay – rubbing very expensive salt on an already very raw wound.”

While the perpetrator was clearly seen on the CCTV stealing Frances’ wallet, she was never caught by the police. To her chagrin, Frances also found out that after viewing the tape, the police said that this same woman had been previously caught but was released because her victim did not want to press charges.

The current status of Frances’ case? Closed. Frances laments: “I paid the entire amount, even when the case was still under investigation. I’m a good customer, even though my bank was not.”

With the benefit of hindsight, Frances strongly advises: “Never leaves your bag unattended! Don’t bring your credit cards, especially the ones with big credit limits! Cash is king!”

Next is business owner Yolly Diolazo, who had a different experience altogether.

One day in the midst of her hectic schedule, someone called her office. The man said that he was connected with PSBank Mastercard, and informed Yolly that she was up for a credit line increase. To avail of this increase, however, she was instructed to surrender her current credit card.

Perhaps she was too busy and harassed to carefully consider the instructions. Perhaps she wasn’t too well versed with the policies and processes regarding credit line increases. Perhaps she was too trusting. Perhaps she was simply careless. And so, she left her credit card with her assistant for the man to pick up.

After a week, Yolly called the card company and inquired if there was really an increase in her credit line. To her surprise, she was informed that the amount of Php16,000 transacted at Sm North was debited from her line. She immediately reported the crime to the credit card company, and they promised her that they would investigate. Her card was put on hold to prevent further fraudulent transactions. But sadly, up to this day, there has been no resolution to her case and the perpetrators were never caught. Nothing happened with the card company’s investigation. Yolly also had no time to follow it up, and no one from the card company ever called her for updates on the status of the case. And she had to pay the amount despite her complaint.

Yolly admits she was duped because she was careless. However, it would have been helped if merchants were not too lenient with credit card transactions. She explains: “It would be good if the card companies require all department stores to ask for an identification card to validate the use of the credit card, especially for large transactions. At least they can compare the signature and especially the picture before they swipe the card. But because very few of them practice that procedure, the criminals can really get away with it.”

Closer to home, SecurityMatters’ very own editor-in-chief Ace Esmeralda shares his experiences. Perhaps because he is a security professional, Ace is not one to be caught off-guard. He regularly checks his billing statements for any anomalous transactions. He uses only one card for a cluster of similar transactions. Ace cites, for example, using ABC card only for utilities and auto debit, while his XYZ card is for groceries alone.

Some years back, on a day tour around Tagaytay and Batangas, Ace misplaced all his active credit cards which he kept in one leather holder. Twenty minutes later and yielding no results after a thorough research of his car, he called the credit card companies to report the loss. Ace continues: “Good thing that all hotline numbers are stored and encrypted in my mobile phones. I decided to call within 20 minutes because stolen credit cards are usually used within 20 minutes after bing stolen or found and until reported lost or stolen and deactivated.” The funny thing was, after he had called the last credit card company, his father found the card holder intact.

A brush with credit card thieves occurred three years ago when there was an attempt to use one of Ace’s credit cards by way of an online banking transaction. The credit card company sent him a text message asking him to confirm the dubious transaction made hours ago. Ace replied that he did not make the transaction. Upon verification of his identity and with Ace correctly answering all their security questions, the credit card company was convinced that indeed, he could not have made the transaction. The card company cancelled the transaction.

Ace remarks: “Credit card companies have instituted security measures that can be implemented at their end, even to the extent of regularly informing their clients to exercise caution or observe their recommended security tips. It is still, however, the card owner (not the user) who is responsible for protecting his cards from all possible crimes or card-related crimes.”

This cautionary tale ends on a happier note, with Ace sharing a successful apprehension of a credit card fraud syndicate.

In his previous role as regional security director of Shangri-La Hotels and Resorts, Ace was instrumental in solving a case of credit card cloning. He recalls: “Way back in 2005, some members of the Credit Card Association of the Philippines (CCAP) met with me and Shangri-La Hotel management regarding their report that a credit card was cloned and used in several stores in Makati and Bicutan malls. The purchases were discovered by the card owner because she only used her card at Makati Shangri-La Hotel. CCAP members were only there to inform Shangri-La about the incident but were not really keen about solving the crime because they believed that such cases are very difficult to solve. They “zeroed in” on Shangri-La Makati because it was the only place where one of the victims used his cloned cards. But as the security director of the hotel that was suspected of harboring or being a venue for card cloning, I took the challenge to unravel the case.”

His investigation went through the following steps: First, he asked for the details of all questionable transactions of all suspected clone cards. (Clone cards are duplicates of the original cards.)

Next, he studied all the transactions of the suspected cloned cards within the outlets of Makati Shangri-La hotel.

Then, he cross-referenced the said transactions with the work attendance of the outlets’ staff. From this study, he was able to single out one cashier as a suspect.

His team conducted active surveillance of the cashier-suspect and caught him red-handed swiping a client’s credit card in his Visor PDA with card reader attachment. The suspect’s act was recorded on video and witnessed by the hotel’s human resources managers.

The investigation of the cashier led to a syndicate of hotel employees who were recruited by a Taiwanese who was the financier and mastermind. Two more members of the syndicate who were then employees of Shangri-La Makati were accosted by hotel security minutes after the suspect’s apprehension and confession. Later, the suspects turned over to the police. The rest of their group who knew that Hotel Security had busted their syndicate resigned on their own.

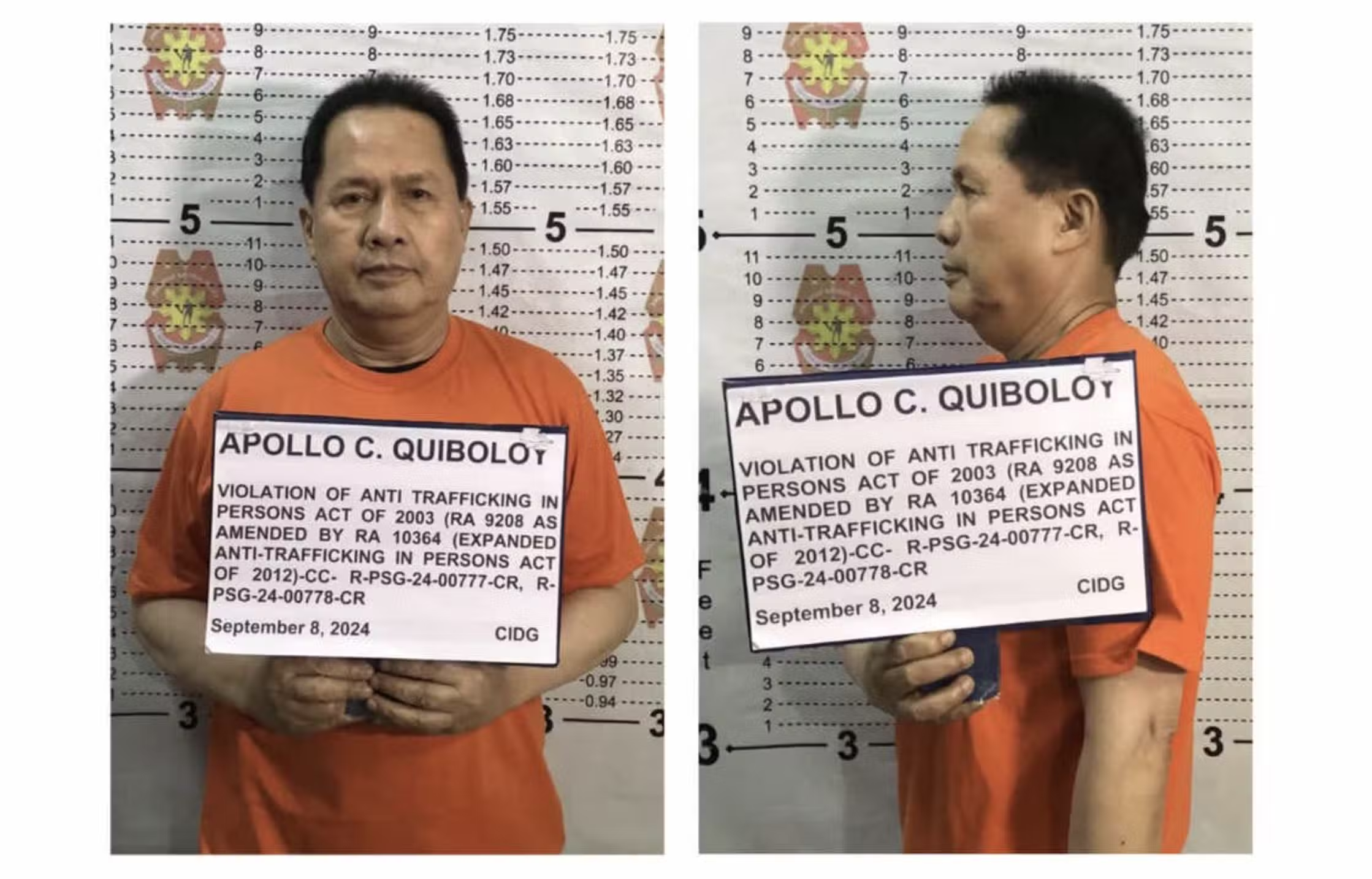

Finally, the suspects were turned over to the PNP, CIDG and CCAP who cannot believe that such case can be solved.

Ace does not only credit the bust to the support of the hotel’s executive committee and his competent security officers but mainly to the vigilant cardholders who noticed the fraudulent transaction and reported them to concerned parties.